Describe the Pros and Cons of a Sole Proprietorship

What is the difference between a sole proprietorship and an LLC. The lease should also describe any certification regulatory or contractual constraints that the renter should be aware of such as the land being certified as organic.

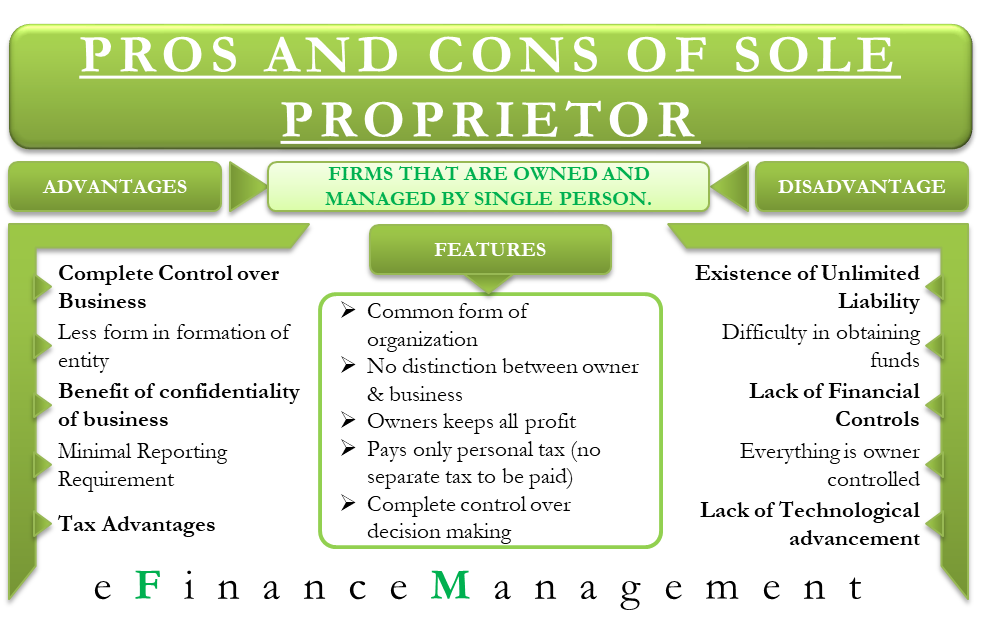

13 Advantages And Disadvantages Of A Sole Proprietorship

A sole proprietorship is a business that a personruns and owns by themself.

. A sole proprietor personally owns a business and all its assets. Partnership Similar to a sole proprietorship but for two or more people. This means that creditors or lawsuit plaintiffs can reach the proprietors personal assets.

Updated May 02 2022 3 min read If youre organizing a small business you should know about the concept of a close corporation an organizational structure that can affect your personal. When one person forms a business without registering another type of business entity they become a sole proprietor by default. Sole proprietorships do not have to be registered federally or with their.

4 X Trustworthy Source US. First define your business structurewhether youre operating as a sole proprietorship partnership or corporation. Templates offer general guidance about what information is needed and how to organize it so youre not stuck looking at a blank page when getting started.

If buildings are included. By Michelle Kaminsky Esq. Make sure you describe the property exactly as it is on prior deeds.

This person is known as a sole proprietor. Corporation A legal entity owned by shareholders. How to create a business plan for a small business.

Beginning a small business requires research to find information about the market and industry of your products or. In order to comply with contract law you must include the amount of money being exchanged even if its only one dollar which is usually the amount paid when property is being given to a close family member or friend. 100 percent of profits go in your pocket.

Liable for all business debts. Registering your business as a corporation establishes it as a separate legal entity protecting you from personal liability if you were to be. The Pros and Cons of Forming an LLC.

An affiliate could be the owner of multiple websites or email marketing lists. A sole proprietorship is not actually a legal business entity. Banks are less likely to issue loans.

Consider these pros and cons to determine whether organizing your small business as a close corporation would be the right choice for your business. Explain how a sole proprietorship or partnership gets its capital. Discuss and explain four ways a corporation obtains capital.

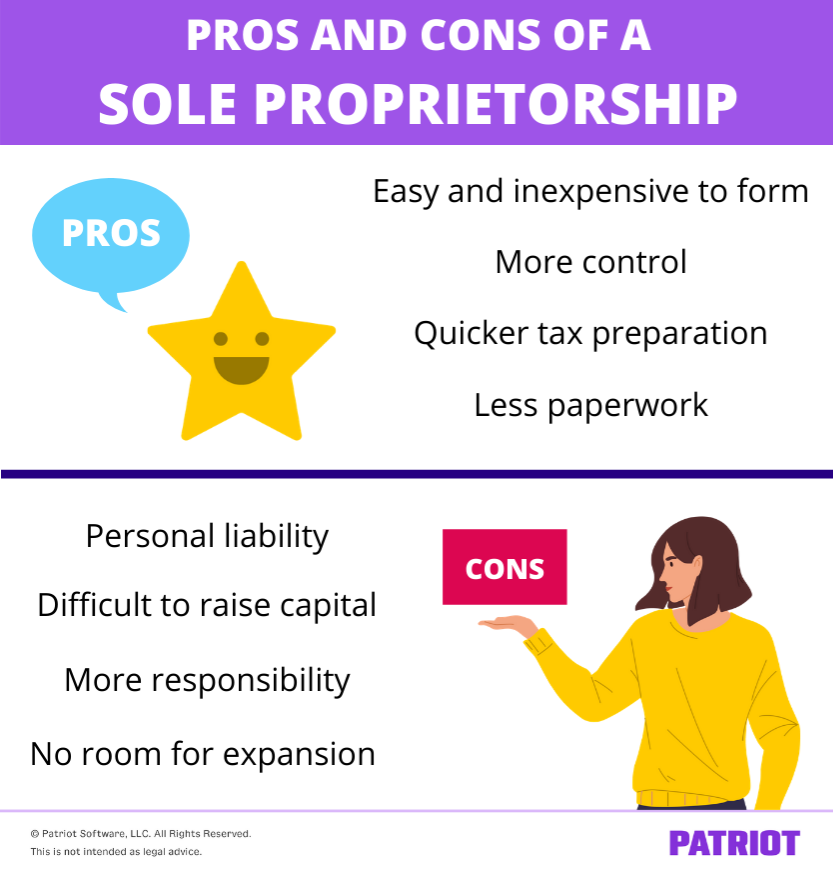

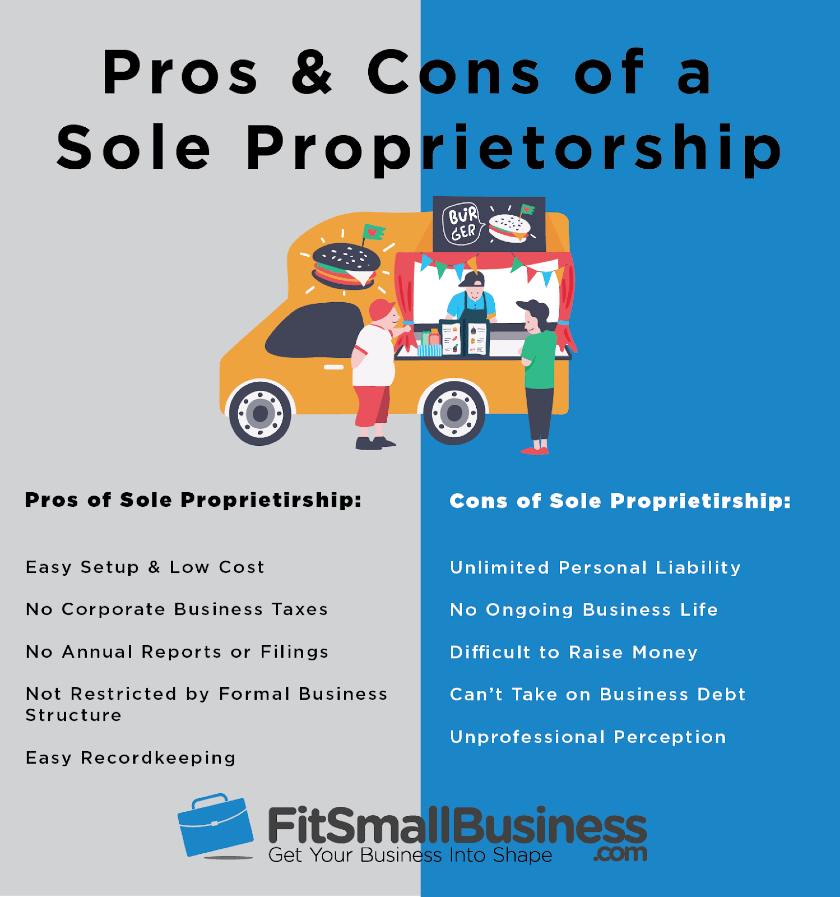

There are many pros to setting up a sole proprietorship the greatest of which is that it is the easiest and least expensive business type to set up. There is no separate business entity involved. Especially detailed templates may offer instructions or helpful text prompts along the way.

If you decide to structure your business as a corporation youll have to register with your states Secretary of State office. Limited liability company LLC A hybrid legal structure that provides the limited liability features of a corporation and the tax efficiencies and operational flexibility of a partnership. Here are four steps you can follow to create and write a business plan for a small business.

One advantage of LLCs is that they are relatively simple to form and maintain. Explain the place of profit in business. No complicated legal agreements found in LLCs or corporations.

Sole proprietorship The most common structure for small businesses makes no legal distinction between company and owner. If you know what type of business plan you needtraditional lean industry. Government agency focused on supporting small businesses Go to source.

There are pros and cons for each option. Name five kinds of insurance useful to business. Its easy to form and offers complete managerial control to the owner.

Describe to your counselor green marketing and sustainable business practices. Complete control of your day-to-day operations. The sole proprietor is personally liable for all business debts and lawsuits.

It should also be clearly stated how the land is to be left after termination of the lease. Sole proprietorship person fizik A business owned and managed by one individual who is personally liable for all business debts and obligations. Pros of a Sole Proprietorship.

A sole proprietorship is the most common form of business organization. The entity provides the owners with. 10 Pros and Cons of Being a Small Business Owner.

Again owners keep the profits and are liable for losses. Pros to Setting Up a Sole Proprietorship. An e-commerce merchant wanting to reach a wider base of internet users and shoppers may hire an affiliate.

However the owner is also personally liable for all. You get to keep all the profits but youre personally liable for all debts. Before you form your LLC consider the benefits and drawbacks of the entity.

While LLCs are a popular choice for new and small businesses the entity is not the best option for every enterprise. Easier to organize and form. Cons of a Sole Proprietorship.

The tenant should be required to adhere to normal farming practices in regard to disposal of manure. Small Business Administration US. The options include but are not necessarily limited to a sole proprietorship partnership and limited liability company LLC.

The term simply describes a person who owns a business and is personally responsible for.

Advantages And Disadvantages Of Sole Proprietorship Efm

Advantages And Disadvantages Of Sole Proprietorship What Is Sole Proprietorship Merits And Drawbacks Of Propri Sole Proprietorship Advantage Raising Capital

Comments

Post a Comment